Citrix Systems Inc. (NASDAQ: CTXS) and SS & C Technologies Inc. (NASDAQ: SSNC) are mid-sized technology companies, but is this a good stock? We compare the two companies based on their return, risk, institutional ownership, valuation, analyst recommendation, dividend and profitability.

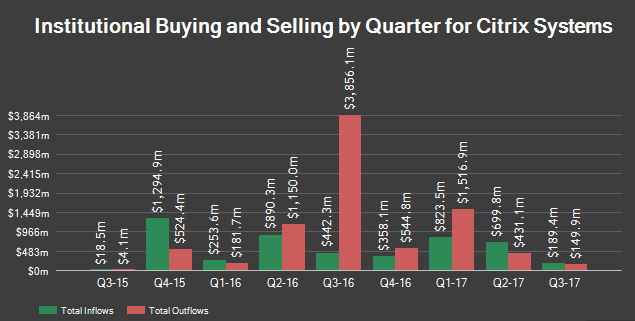

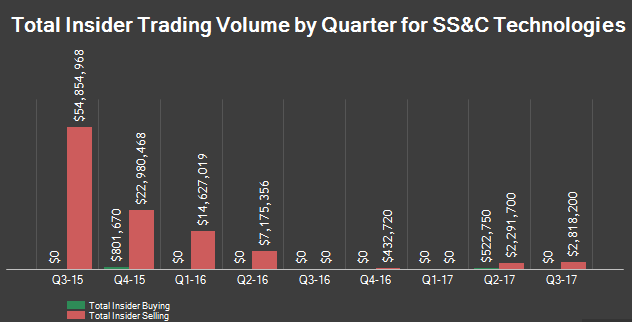

94.4% of Citrix Systems is owned by institutional investors. 86.7% of SS & C Technologies’ shares are owned by institutional investors. 0.4% of Citrix Systems shares are owned by insiders. 17.6% of SS & C Technologies’ shares are owned by insiders. Strong institutional ownership means endowment, big fund managers and hedge funds think the stock is ready for long-term growth.

Risk and volatility

The Citrix beta of 1.41 means that its stock price is 41% higher than the S & P 500. In contrast, SS & C Technologies’ beta is 1.08, which means its stock price is 8% higher than the S & P 500.

Valuation and earnings

The table compares Citrix Systems and SS & C Technologies’ earnings, earnings per share (EPS) and valuation. Citrix Systems has higher revenue and revenue than SS & C technology. The price-earnings ratio for Citrix Systems is lower than SS & C Technologies, indicating that the current prices of both stocks are more affordable.

Dividends

SS & C Technologies pays a dividend of $ 0.28 a share, yielding a dividend yield of 0.7% per annum. Citrix Systems does not pay dividends. SS & C Technologies paid 26.7% of its revenue in the form of dividends.

Analysts recommend

This is a summary of the current ratings from Citrix Systems and SS & C Technologies, courtesy of MarketBeat.com. The current consensus consensus for Citrix Systems is $ 89.50, indicating a potential gain of 2.70%. The target price for SS & C Technologies is $ 43.33, indicating a potential upside of 4.44%. Given SS & C Technologies’ higher consensus rating and higher probability of upside, analysts clearly believe SS & C Technologies is better than Citrix Systems.

Profitability

This table compares the net profit margin, return on equity and return on assets of Citrix Systems and SS & C Technologies.

Summary

Citrix Systems outperformed the SS & C technology in 10 out of 17 factors compared to the two stocks.

Citrix Systems Company Profile

Citrix Systems, Inc. provides enterprise and service provider products, including work area service solutions and delivery network products. The company’s enterprise and service provider offerings include cloud service solutions, along with related license update and maintenance, support and professional services. The company’s NetScaler nCore technology is an architecture that can execute multiple packet engines in parallel.

The company’s workspace services include application virtualization and virtual desktop infrastructure (VDI), enterprise mobility management and Citrix workspace suites. The company’s NetScaler ADC is a software-defined Application Delivery Controller (ADC) and load balancer. The company’s cloud services include ShareFile and Citrix Cloud. It offers customers a variety of ways to receive product upgrades, support and maintenance, including software maintenance, ordering advantages, technical support services and hardware maintenance.

SS&C Technologies Company Profile

SS & C Technologies Holdings, Inc. is a holding company. The company is a provider of software products and software support services that allow financial services providers to automate complex business processes and manage their information processing requirements.

The company’s portfolio of software products and software services enables its customers to automate and integrate front-end functions such as transaction and modeling, middle-tier functions such as portfolio management and reporting, and back-office functions such as accounting, performance measurement, reconciliation, reporting, Processing and settlement. The company provides solutions to more than 11,000 customers worldwide, including institutional assets and wealth management, alternative investment management, financial advisory and vertical markets for financial institutions. Its product portfolio includes over 90 product and support software services.